We are really excited to announce the launch of our brand new Smart Money Club! Here at Prudent we are committed to helping Canadians become financially secure, and that means providing knowledge and tools to help get you there.

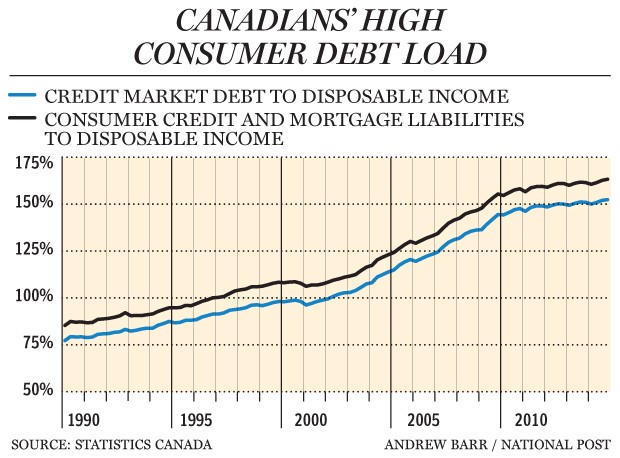

A recent Statistics Canada report sheds some light on just how dire our financial straits are becoming and why financial security is becoming increasingly more significant:

- More than a third, or 35 per cent, of families had a debt-to-income ratio above 2.0 as of 2012, meaning their overall debt level was at least twice that of their annual after-tax income.

- Canada’s debt-to-income ratio continues to rise, and it hit a record 163.3 % in the fourth quarter of last year.

- The median debt held by indebted families grew to $60,100 in 2012 from $36,700 in 1999.

Financial literacy is so important – and the Smart Money Club can help you become more confident! Follow us here:

- Facebook: https://www.facebook.com/prudentfinancial

- LinkedIn: https://www.linkedin.com/company/prudent-financial-services

- Twitter: @PrudentLoans