It is time to get saving! Have you looked at your budget recently? Do you even have one? Saving money and keeping finances on track is a great way to prepare for the future and mitigate any unforeseen expenses.

It is time to get saving! Have you looked at your budget recently? Do you even have one? Saving money and keeping finances on track is a great way to prepare for the future and mitigate any unforeseen expenses.

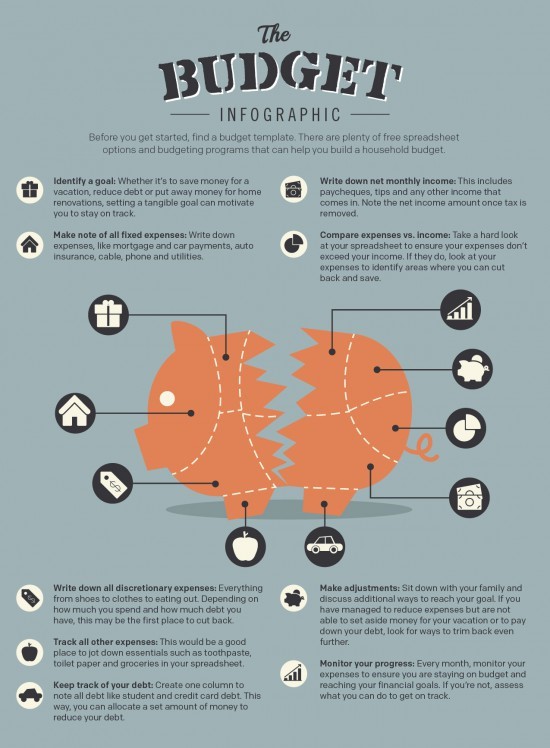

We know that people take in information in a variety of ways, so this week we thought we’d share a great visual from our friends at H&R Block – an infographic on creating and maintaining a strong household budget! Check it out, then use the advice to get your own household budget started!

Tips:

- Find and use a budget template to track all financial income and expenditures

- Identify a goal – this will help keep you motivated

- Keep track of your debt – this will help you avoid getting in over your head

- Look for ways to cut back

- Monitor your progress and make changes when necessary

- Watch your savings grow!!

A strong household budget can make all the difference when it comes to managing your family finances – sometimes you just need a little help. Prudent Financial can provide a personal loan at a competitive rate to help you get things back on track. Contact us today at 1-888-852-7647.