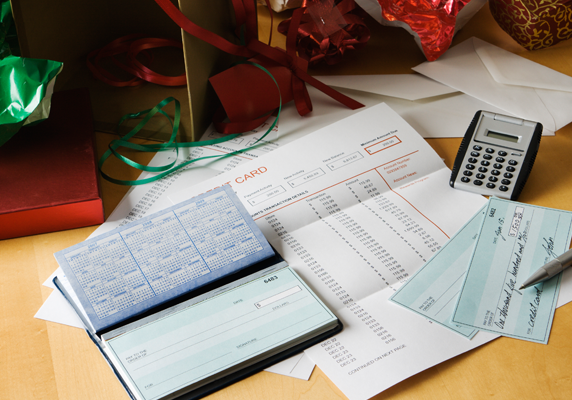

The holiday season may be over, but there’s one part of it that isn’t finished yet: holiday bills.

The holiday season may be over, but there’s one part of it that isn’t finished yet: holiday bills.

Many holiday shoppers tend to put purchases on their credit cards, which means that after the holidays are done, they have to deal with the corresponding credit card debt.

The 2018 holiday season was no exception, although Canadians fared better than in previous years.

According to Moneris Solutions Corporation, the final quarter of 2018 finished with a 3% increase in spend over the same period in 2017. While Canadians still spent 3% more than in 2017, the increase marks the lowest quarterly rise for 2018 and the lowest quarterly growth in four years.

“Every quarter of 2018 saw an increase in spend, but the increases overall were more tempered than in years past,” said Angela Brown, President and CEO of Moneris. “This is a trend we expect to continue throughout 2019, with spending to be cautious and growth to be moderate.”

Black Friday saw an increase in spending volume of 6% over 2017. Boxing Day spending increased by 5.57%. Other busy shopping days included December 21 and 22.

According to RBC, overspending dropped significantly over the 2018 holiday spending. Their annual Post-Holiday Spending & Saving Insights Poll found that Canadians spent an average of $384 last year, compared to an average of $530 in 2017.

The biggest drop was among 18-to-34-year-olds and women. Almost one-third of overspenders report that they’ve already paid off their seasonal purchases.

If you still have debt leftover from the holidays, don’t worry. Depending on the type of debt, you have different options for paying it off.

For instance, you might consider:

- A short-term consolidation loan.

This is a great option if you are carrying high-interest debt, such as credit card debt or a payday loan.

When you take out a consolidation loan, you can pay off your high-interest debts with the money and then pay back the consolidation loan at a fixed interest rate and over a fixed repayment schedule. This is much more manageable to plan for in your budget.

- A home equity loan.

If you are carrying a greater amount of debt, you may be able to pay it off through leveraging your home equity, or even leveraging a paid-off car.

For instance, at Prudent Financial we offer the options to borrow with your home or borrow with your car.

Consider what assets you have that could be used as collateral against a loan.

Although spending dropped over the 2018 holiday season, many Canadian shoppers say that they are still finding it difficult to save for next year, especially with increased interest rates. Try to start saving for your 2019 holiday shopping now by creating a manageable budget.

At Prudent Financial we can help with budget planning and debt consolidation. Contact us today to get started.

Call 1-888-852-7647 or visit www.prudentfinancial.net.